3 Ways to Exercise Your Stock Options

There are 3 different ways to exercise your stock options—whether that’s incentive stock options (ISOs) or nonqualified stock options (NSOs)—this article will shed some light on the subject.

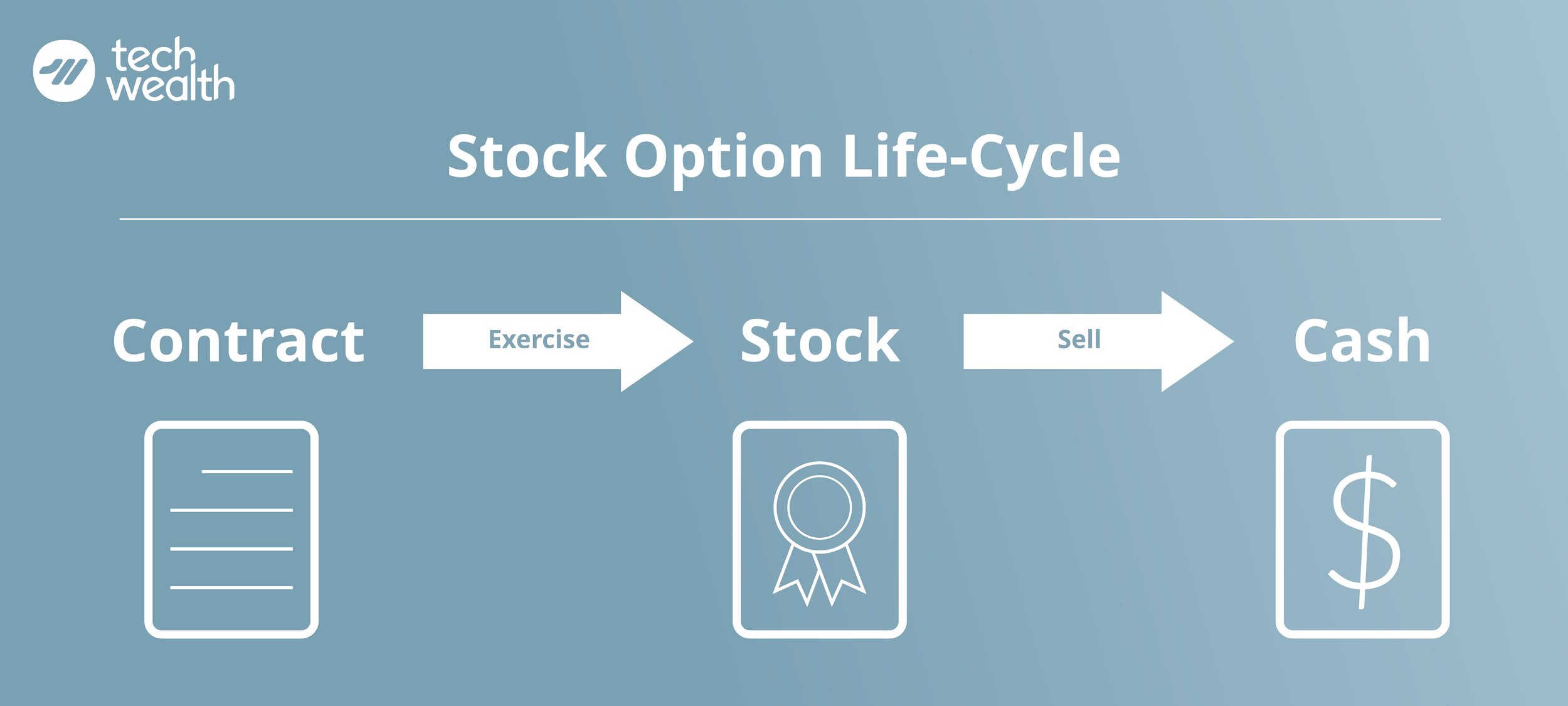

Before we discuss the different ways to exercise, it’ll be helpful to review the life-cycle of a stock option. This will help our understanding of exercising and what it actually means. When you start at a company and you’re granted an option, remember that you don’t own shares at that point. You are not an owner for two reasons. 1) You probably haven’t vested shares yet (typically there is a 4 year vesting schedule). 2) Even if one is vested, they haven’t purchased their stock—also known as exercising their stock. When you exercise, you are using your contractual right to purchase shares. Simply put, exercising options = purchasing shares. So until you exercise, you don’t own shares.

To recap, one is granted a contract. The contract has stipulations one must meet to purchase the shares. If one meets the contractual stipulations (vesting, etc.), they may then use the contract to buy shares. Shares can then be kept, sold for cash, or donated.

Up until now, you’re probably only familiar with the term “exercise” but we’re going to take that a step further. I will organize the different ways to exercise according to risk appetites. There are roughly three different ways to exercise:

Exercise and Hold

Sell to Cover

Exercise and Sell

As always when you’re dealing with an investment, you’re dealing with risk. So let’s start with the riskiest option—exercise and hold.

Exercise & Hold

When one exercises and holds their stock, they’re typically looking to hold for for at least one year from the date of exercise. This is because there are tax benefits for doing so. One tax benefit of holding for more than one year is for called qualifying disposition (only available for ISOs & ESPPs). Qualifying disposition will treat the whole spread from the grant price to the fair market value on the date of sale as long-term capital gains (LTCG). Often times, this one year holding requirement is forced on employees of private companies because there aren’t opportunities to sell. Others are more strategic about getting the best tax rate (long-term capital gains). As soon as one exercises (through an early exercise or not), that 1 year timer starts.

Another reason one would hold for the long-term, would be for another tax benefit called Qualified Small Business Stock (QSBS). These are the main drivers of people exercising and holding. This typically works best for people who have a high risk tolerance and capacity, larger net worth or income, are seeking the best tax rates, aren’t in need of the cash, and believe in the future of their company.

Advantages

The main reason one would exercise and hold is for the tax benefits—namely qualifying disposition (for ISOs or ESPPs) or qualified small business stock (QSBS). The tax benefit is getting the gains from the basis up taxed as a long term capital gain (LTCG). ISOs and ESPPs were given a tax advantage by the government to incentivize people to build/grow companies and stick with them for the long term. When businesses (especially small businesses) do well, the economy as a whole benefits. As such, the IRS incentivizes holding for the long-term.

Disadvantages

Among the 3 different ways to exercise—exercise and hold, involves the most risk. When one exercises, they’re taking their cash and investing it. As such, there is a chance of losing the money that they invested. Not only does investing involve risk, but investing in a single holding is even more risky. Remember that phrase about not putting all your eggs in one basket? Yeah, well this goes contrary to that advice. To be fair, some people have a larger portfolio that enables their exercised money to equate to a smaller portion of their net worth. As such, they can afford to do this.

Another disadvantage is loss of liquidity. When one exercises, they lock their money up in their company stock until they can sell. For those who own stock in private companies, they may find it very difficult to sell. This is because one can’t sell private stock as easily or as quickly as public stock (like you’d see on a public exchange such as NASDAQ or NYSE). Just know, when you exercise in a private company, there is no promise on getting your money back soon, if ever.

Exercise & Sell

On the other side of the risk spectrum, there is the exercise-and-sell strategy, often referred to as a Same-Day Sale. A Same-Day Sale strategy typically works best for those who have a low risk tolerance and capacity, smaller net worth, lower income, minimal cash, aren’t concerned about the best tax rate, and skeptical about company’s future.

Advantages

The main reason one would perform a same-day sale would be to avoid risk or get quick liquidity. Because NSOs don’t have an exclusive tax benefit (like ISOs, and ESPPs have), it can often makes sense to take this approach when you own NSOs if you’re trying to optimize for taxes.

Disadvantages

If the company takes off, those who sold prematurely, don’t get to participate in the gains. The other disadvantage of this approach is the automatic disqualifying of the beneficial tax treatment of ISOs and ESPPs.

Sell to Cover

A sell to cover is a great way to get the best of both worlds. It’s similar to an exercise and hold, but the difference is in how those shares are exercised. When one exercises their stock options, they have to pay for those shares. Often times, they may own so many shares that they can’t afford to pay for the exercise cost. A sell-to-cover is a great way to fund the cost of exercising.

Advantages

The main reason one would perform a sell-to-cover would be to avoid risk of investing their own cash. This allows you to become an owner of shares without investing your own cash. Perhaps you may need some money for a future down payment or education, etc. So you decide that you’d rather keep your cash, and sell a few shares to cover the exercise cost and any associated withholdings. You get to keep your cash and get exposure to the future upside of the company.

Disadvantages

The disadvantages of Sell-to-Cover are the least advantageous tax rates (ordinary tax rates) on the shares you used to exercise the rest. The remaining shares are subject to overconcentration in an attempt for a better tax rate.